Benefit from Restoring Your Flat Roof With A New Roof Coating

Why Restore Your Roof vs Replacing It?

Costs 75% Less Than A Replacement

Reduce Your Energy Bill By 20%

100% Tax Deductible In Year 1

Roof Coatings: Financial Benefits and Long-Term Savings

Roof coatings are a sustainable and cost-effective solution designed to extend the lifespan of existing roofs, enhance energy efficiency, and reduce operational costs for commercial properties. These coatings create a seamless, waterproof barrier that protects the roof from UV damage, weathering, and leaks while reflecting heat to lower cooling costs. Beyond their immediate practical benefits, roof coatings offer significant financial incentives through various tax deductions, rebates, and financing options. These factors collectively make roof coatings an attractive investment that pays for itself over time.

Cost and ROI Analysis

For a 300,000 square foot roof, the application of a roof coating can be a substantial investment. At an estimated cost of $4.00 per square foot, the total project would cost approximately $1.2 million. However, this upfront cost is offset by a combination of federal, state, and local incentives, as well as long-term energy savings.

Federal Tax Incentives

179D Commercial Building Energy Efficiency Tax Deduction: The 179D deduction provides a tax deduction of up to $5.00 per square foot for energy-efficient improvements, including roof coatings that achieve at least a 25% reduction in energy consumption. For a 300,000 square foot roof, this could result in a $1.5 million deduction, leading to tax savings of approximately $315,000 at a corporate tax rate of 21%.

Energy Investment Tax Credit (ITC): If the roof coating is part of an integrated renewable energy system, such as a solar roof, it may qualify for the ITC. This credit allows businesses to deduct 30% of the installation cost, which could amount to $360,000 on a $1.2 million project.

State of Colorado Incentives

10% Income Tax Credit: Colorado offers a 10% income tax credit on the cost of energy-efficient improvements, resulting in $120,000 in savings for the project.

2.9% Sales Tax Exemption: Applicable to materials used in the roof coating project, this exemption can save approximately $17,400, assuming materials account for $600,000 of the total cost.

Local Utility Rebates

Local utility companies, such as Xcel Energy, offer rebates for energy efficiency improvements, which can further reduce the net cost of the project. For example, a rebate of $0.10 per square foot could provide an additional $30,000 in savings for the 300,000 square foot roof.

Long-Term Energy Savings

Reflective roof coatings can reduce cooling costs by up to 15%, leading to significant annual energy savings. For a commercial building with annual cooling costs of $500,000, a 15% reduction would save $75,000 per year. Over 10 years, these savings would accumulate to $750,000, effectively contributing to the roof coating paying for itself over time.

Financing Options

C-PACE Financing: Colorado’s Commercial Property Assessed Clean Energy (C-PACE) program allows commercial property owners to finance 100% of the project cost through a special property tax assessment, which can be spread out over 20 years. This financing method often results in positive cash flow from the outset, as the annual energy savings typically exceed the annual assessment payments.

RENU Loans: The Colorado Residential Energy Upgrade (RENU) loan program offers low-interest loans for energy-efficient upgrades. Although primarily for residential properties, some commercial properties may qualify, providing another financing option that can be combined with other incentives.

Grant Opportunities

Renew America’s Schools Grant Program: This federal program provides grants for energy-efficient improvements in K-12 public schools, including roof coatings. While this program is specific to schools, it underscores the broader support for energy-efficient roofing solutions.

Inflation Reduction Act (IRA) Funding: The IRA offers various grants and rebates for energy efficiency improvements in commercial buildings. These grants can significantly reduce the upfront cost of roof coatings, making the investment even more appealing.

OUR PROJECTS

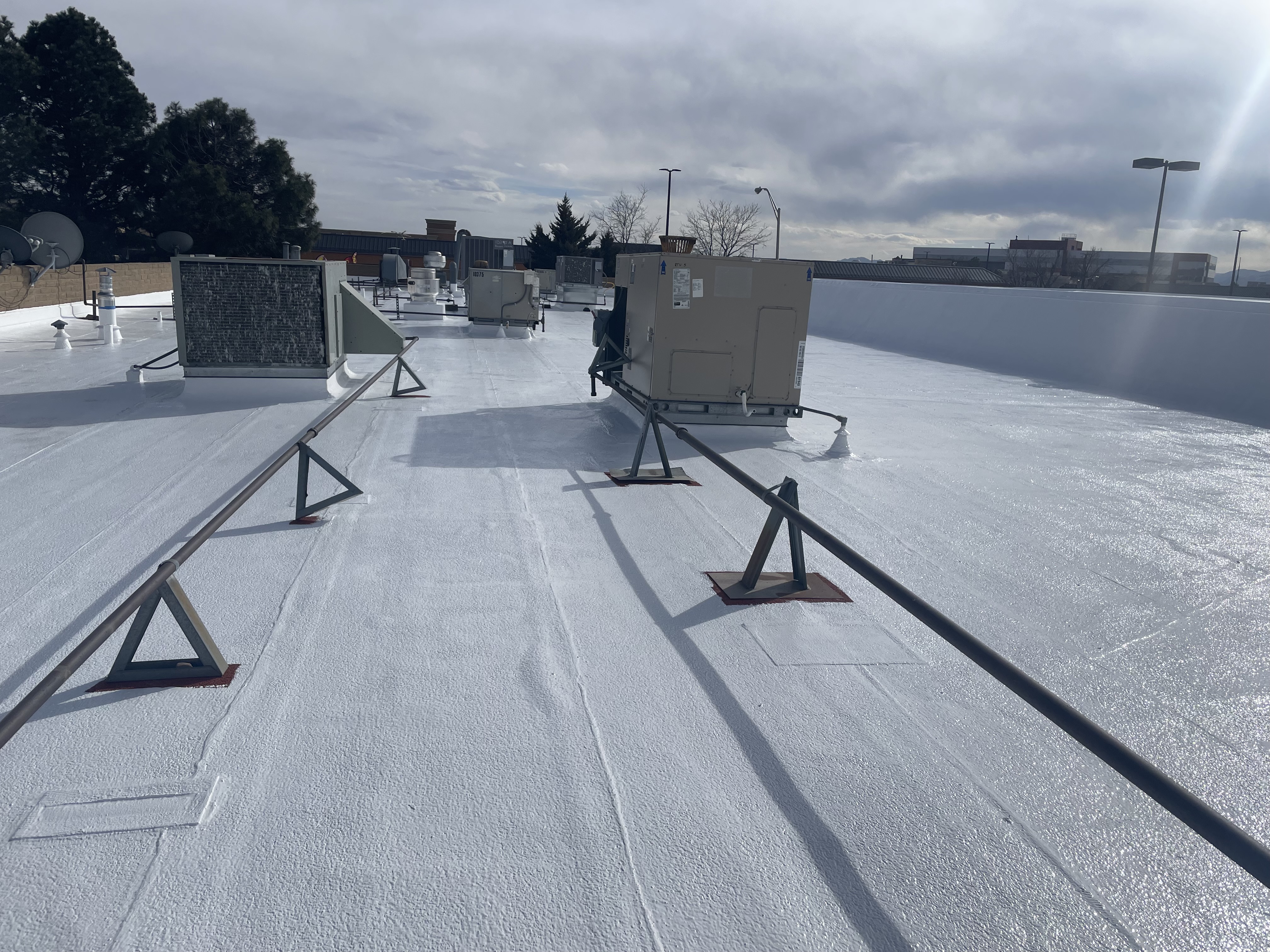

Check Out Our Restoration Projects

Before

After

Why Choose

Blue Peaks Roofing?

Experienced Professionals: With years of experience, our team delivers exceptional results.

Colorado Focused: We understand the unique challenges of Colorado’s climate and provide solutions tailored to withstand local weather conditions.

Customer-First Approach: We offer warranties and stand behind our work, ensuring your complete satisfaction.

How To Save with A Roof Restoration?

Lower Upfront Costs

Skip costly tear-offs and landfill fees with a more budget-friendly restoration option.

Minimal Interruption

Our process keeps your business running smoothly without causing downtime or distractions.

Attractive Tax Deductions

Take advantage of tax benefits by writing off the restoration costs within the current year.

Cut Energy Bills

Enhanced insulation means better temperature control and lower energy expenses.

Boost Roof Longevity

Weatherproof and UV-resistant, our coatings help your roof stay strong for years to come.

Eco-Friendly Choice

Restoration minimizes material waste, keeping your project environmentally conscious.

Restore Your Roof and Save Money Today. Contact Us For A Free Estimate.

Don’t wait for small problems to become big ones. Contact Blue Peaks Roofing for a free roof assessment and discover if roof restoration is right for you.